PURPOSEAre you confident that your

market risk policy is efficient?

In our experience, corporations often operate inefficient risk policies, missing out on cost-effective risk reduction, and on frameworks that clearly link hedging to their financial priorities and to shareholder value.

The culprit is the current state of the art which goes barely beyond risk mapping. Deciding what to optimise and how can be overwhelming.

London|

Paris

Currencies|

Fixed income|

Commodities

PURPOSE

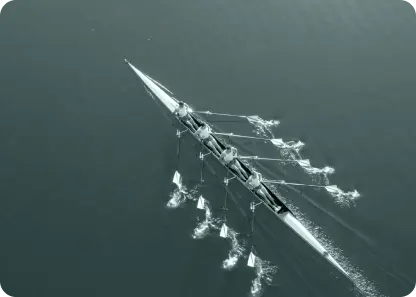

Bridging the gap with strategic risk management

This is where we excel. With years of experience advising clients and building robust frameworks, we set a standard and empower strategic and efficient risk management.

London|

Paris

Currencies|

Fixed income|

Commodities

WHAT SETS UP APART

Clear methodology, real transformation

Our methodology transforms your financial thinking, treating hedging as an investment decision informed by portfolio optimisation and investment management best practices.

We integrate your corporate context and priorities, bridging corporate finance and investment realms.

Our unique framework dispels the fog surrounding hedging, working to align risk management with your strategy and unlock value.

London|

Paris

Currencies|

Fixed income|

Commodities

Our services

C-Suite Advisory

Guiding the board and C-suite is central to our approach, aligning with their risk priorities to optimize the group's overall risk policies and practices.

Organisational Alignment

We help you build a robust strategic risk infrastructure, encompassing data organization, dashboard implementation, and team training to support your strategic approach.

MRO Outsourcing

Explore our virtual Market Risk Officer (MRO) service, an efficient and substantive solution to enhance your risk management capabilities.

London|

Paris

Currencies|

Fixed income|

Commodities

SERVICES

Diagnostic Tool

Start with a diagnostic. We have made it easy to process and insightful.

Running our in-house software navir™ on your exposure data will provide clarity on your risk policy efficiency and illuminate our framework.

London|

Paris

Currencies|

Fixed income|

Commodities

NAVIR TM

Expert advice meets cutting-edge technology

Meet navirTM

Meet navirTM, our in-house software – the digital backbone of our framework and analytics.

Experience navirTM

Using navirTM enhances our advice with unmatched responsiveness, reliability, and interactivity.

Invest in technology

We invest in technology to elevate our consulting service and disseminate our framework, fostering an effective risk culture.

OUR EXPERTISE

Over 20 years of pioneering experience

Navirco's approach is forged from decades of leadership in strategic risk advisory and solutions at tier-one financial institutions like Merrill Lynch and Bank of America.

We boast a strong track record in strategic hedging, principal risk management, and C-level advice on risk priorities for global clients across industries and regions.

London|

Paris

Currencies|

Fixed income|

Commodities

Fill out the form

Enter your contact details in the form below, we will contact you and advise on all issues.

Contact